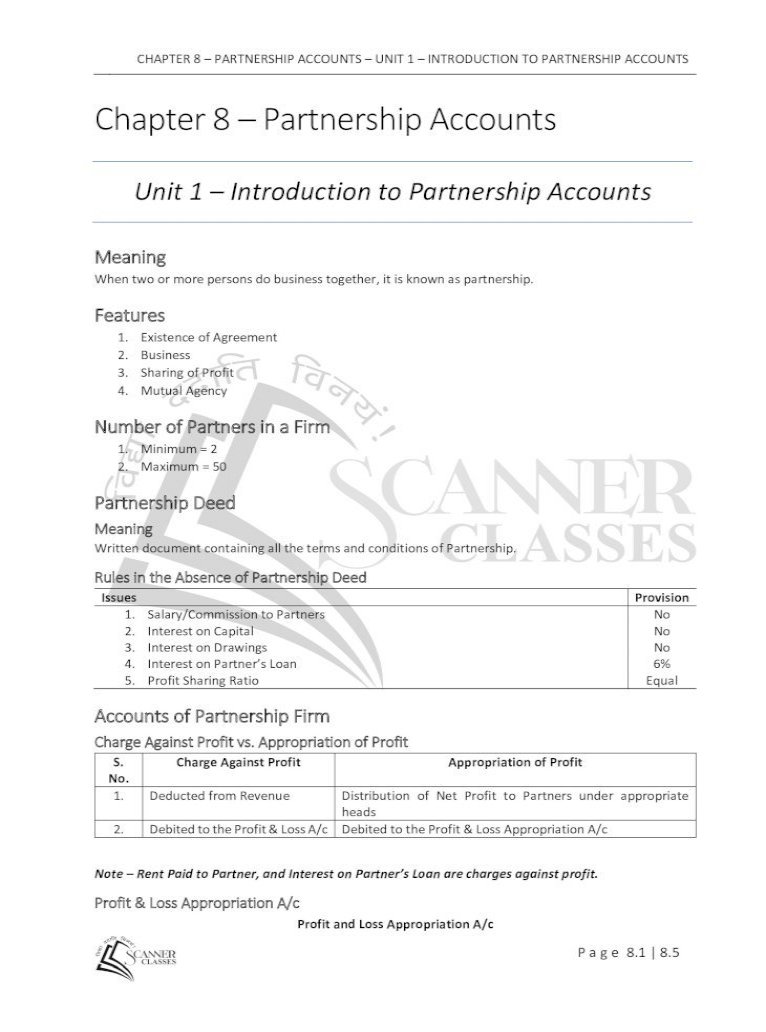

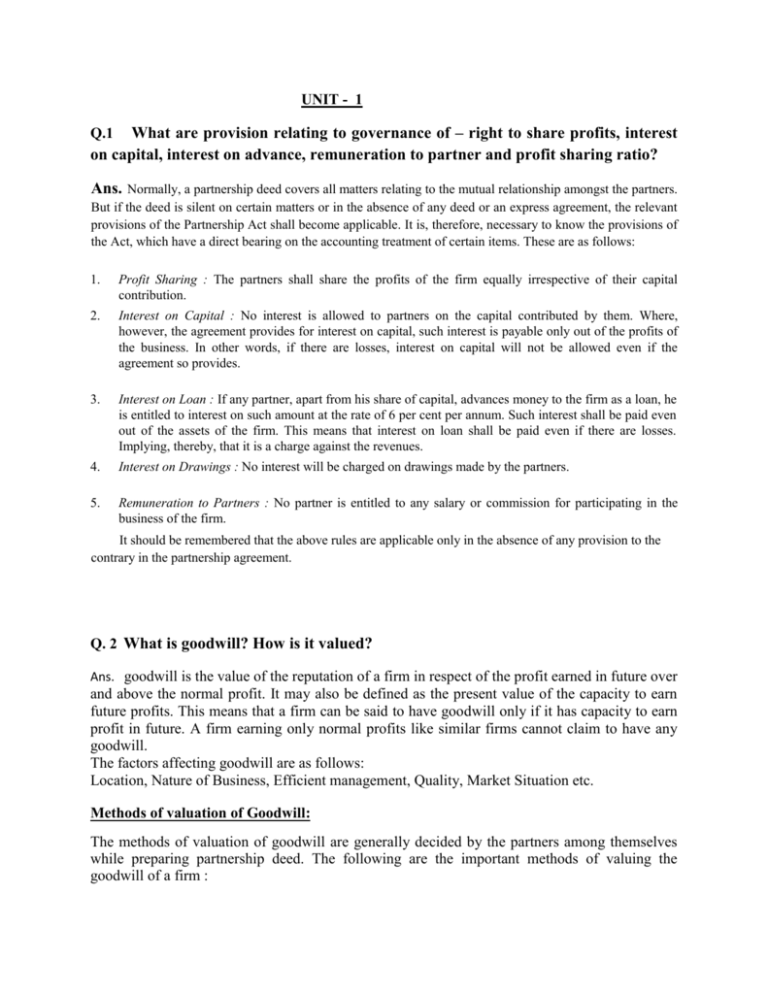

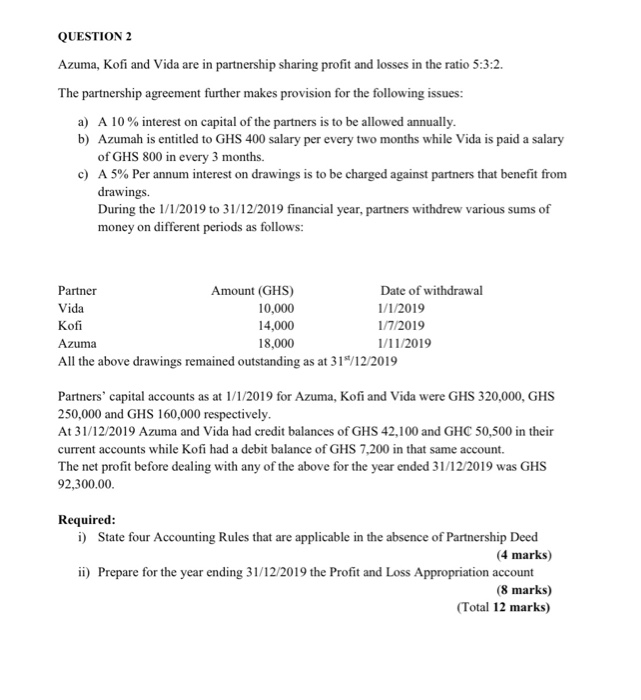

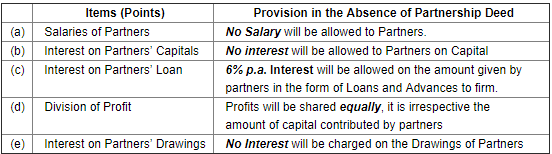

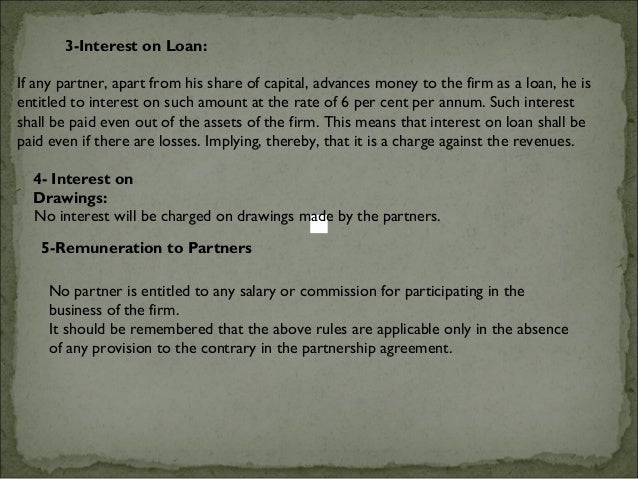

Answer In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners to the contradiction of section the partners ar12/1/21 Normally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If as per the partnership deed, interest is allowed, it will be paid only3/7/11 In the absence of partnership deed the profit and loss arising from the partnership business is shared equally by the partners It is not shared according to capital contributed by the partners;

Change In Profit Sharing Ratio Introduction Reconstitution Of Partnership Firm Youtube

In the absence of partnership deed what are the rules relating to profit sharing ratio

In the absence of partnership deed what are the rules relating to profit sharing ratio-19/7/21 Answer In Equal Ratio 4 In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6% (B) 6% pa 12% (D) None of theseSep 16,21 In the absence of partnership deed ,in which ratio do the old partners sacrifice their share of profit in case of admission of new partner?

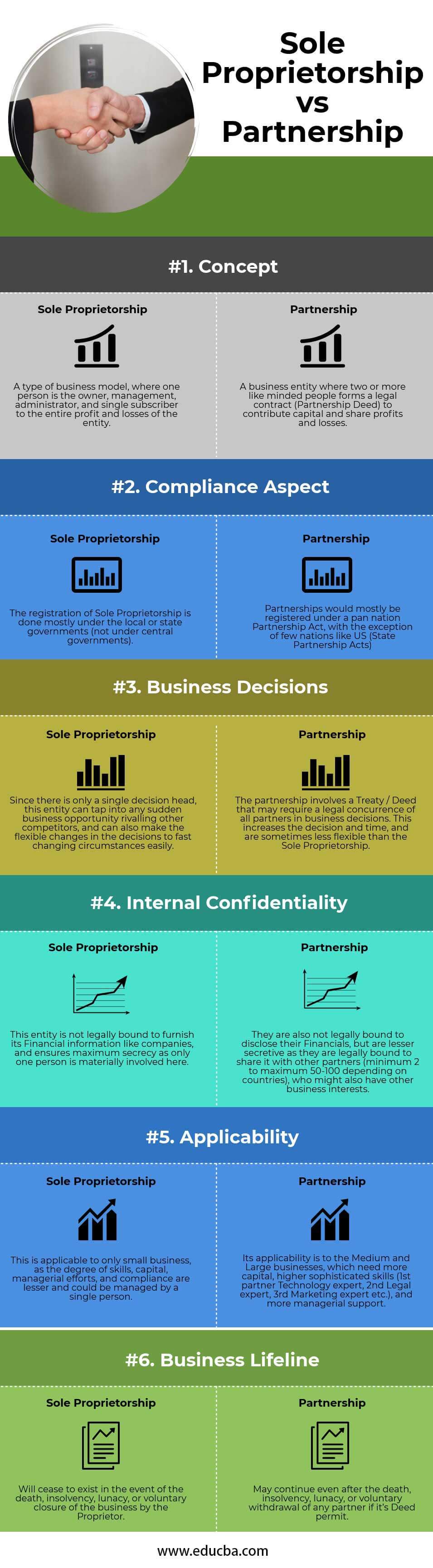

Partnership Definition Features Advantages Limitations

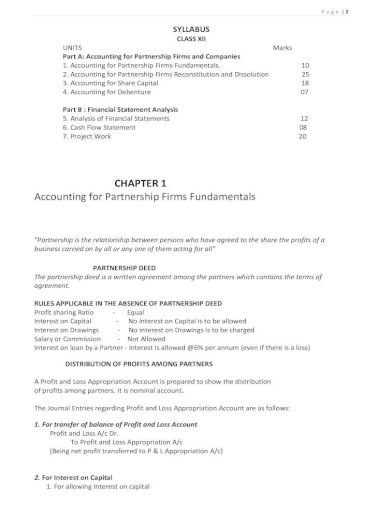

EduRev Commerce Question is disucussed on EduRev Study Group by 1237 Commerce Students13/9/18 Rules applicable in the absence of Partnership Deed Sharing of Profits – In the absence of any partnership deed, the profits among the partners should be shared equally Salary/commission to the partners The partners won't get any portion of profit as salary/commission for their active participation in the businessIn the absence of a partnership deed, the under mentioned provisions of the Partnership Act, 1932 will be applicable (1) Profit and losses are to be shared equally (2) No interest is to be allowed on capitals

29/9/19 The following are the provisions that are relevant to the partnership accounts in absence of partnership deed (i) Profit Sharing Ratio When a partnership deed is not made or even if it is made and silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act 1932, profits and losses are to be shared equally among all the1/4/21 Question 5 In the absence of Partnership Deed what are the rules relating to(a) Salaries of Partners;7/8/21 In the absence of partnership deed, no interest in allowed on capital and no interest is charged on drawings Answer 11 – c) No interest will be allowed and charged Explanation 12In the absence of partnership deed, each partner gets equal share in profit, no matter how much contribution made by him including sleeping partner

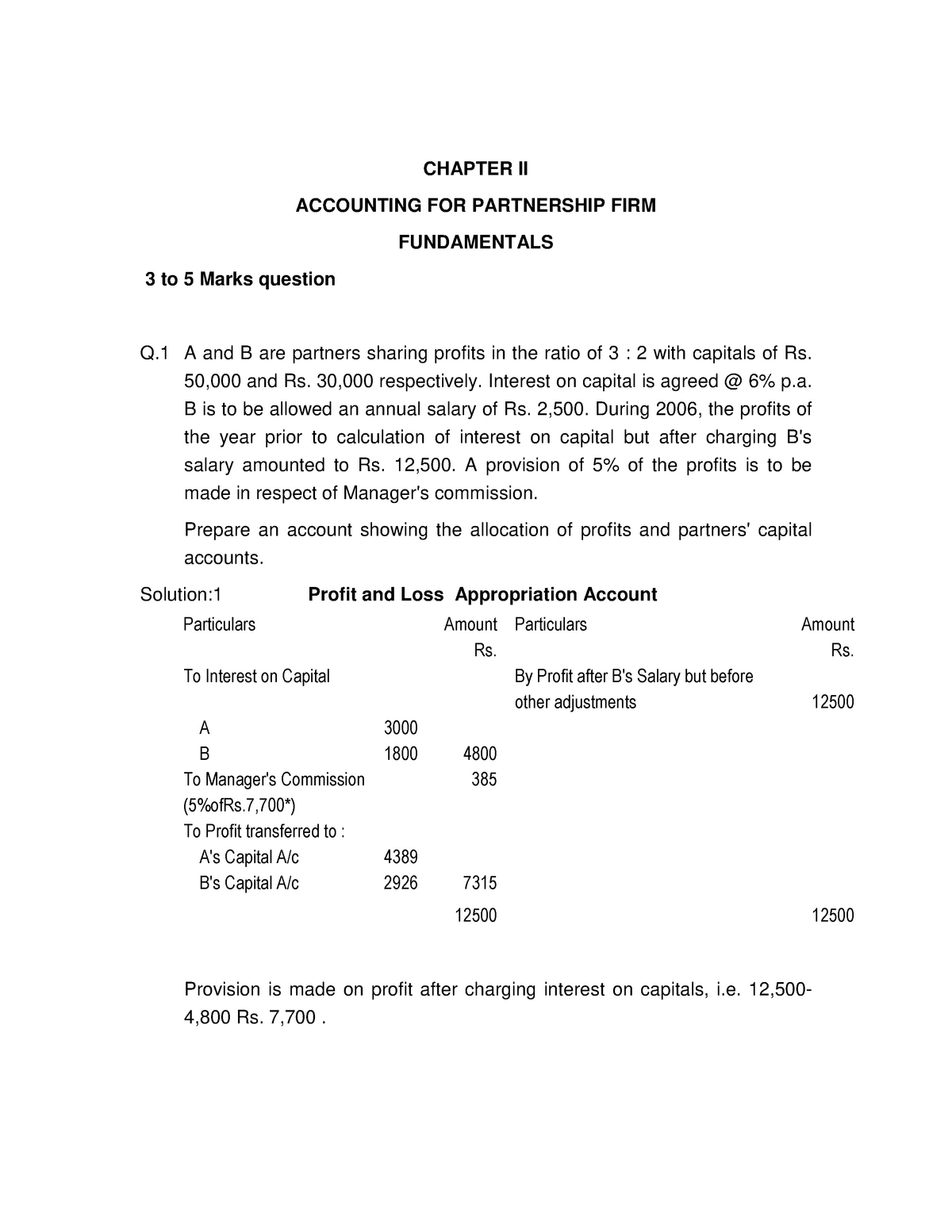

(d) Profit sharing ratio;X, Y and Z are partners sharing profits and losses equally As per Partnership Deed, Z is entitled to a commission of 10% on the net profit after charging such commission The net profit before charging commission is Rs 2,,000 Determine the amount of commission payable to ZEduRev CA Foundation Question is disucussed on EduRev Study Group by 1030 CA Foundation Students

Provisions Of Partnership Deed Indian Partnership Act 1932

2

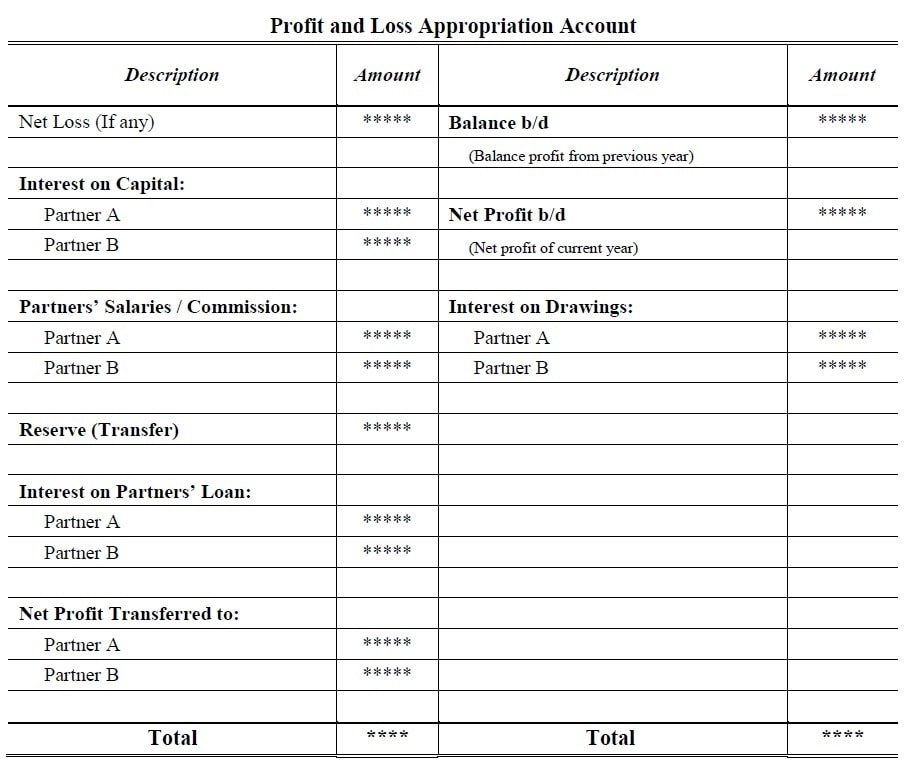

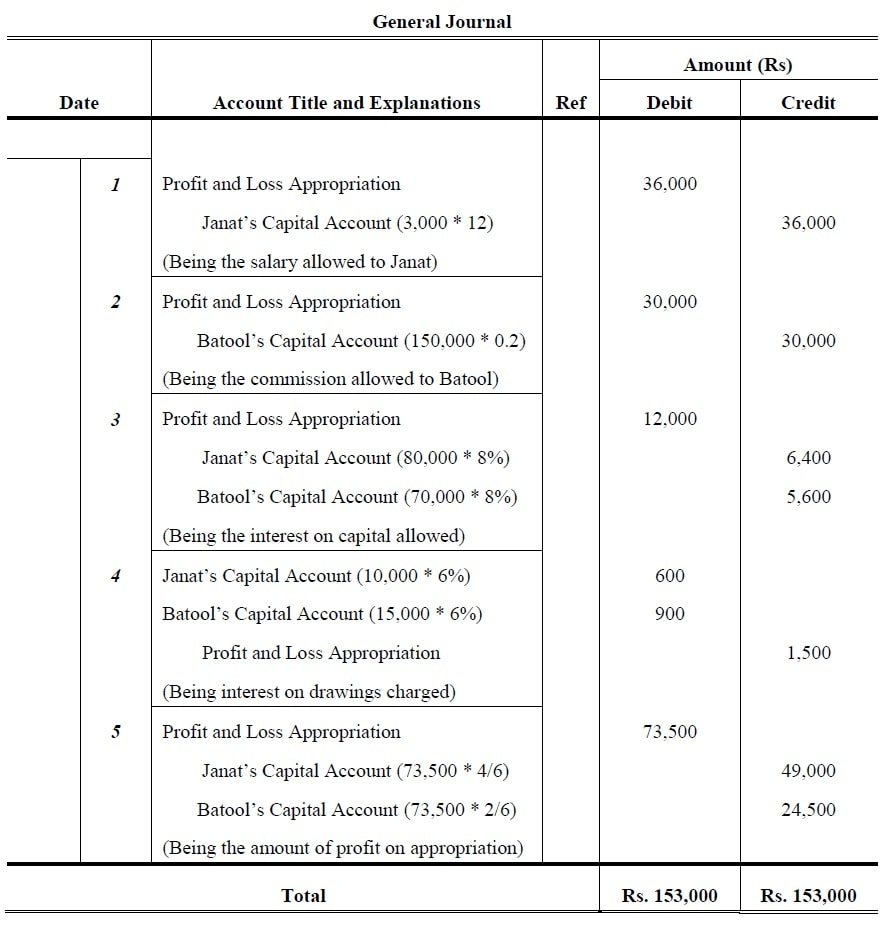

SOLUTION (i) Sharing of Profits and Losses In the absence of partnership deed profit sharing ratio among the partners will be equal (ii) Interest on Partner's Capital In the absence of partnership deed interest on partner's capital will not be given (iii) Interest on Partner's Drawings In the absence of partnership deed no interest will be charged on partner's drawings9/2/ Profit and loss appropriation account is used to distribute profit among partners in the case of partnership business The net profit as shown by the profit and loss account of a partnership firm needs certain adjustments with regard to interest on drawings, interest on capitals, salary/commission to the partners, if provided, under the agreementFor a general partnership deed, the below mentioned information should be included Name of the firm as determined by all partners Name and details of all the partners of the firm The date on which business commenced Firm's existence duration Amount of capital contributed by each partner Profit sharing ratio between the partners

Rights And Responsibilities Of Parties In A Partnership Firm Under Partnership Act 1932 Lawzilla

Partnership Rules Faqs Findlaw

Friends welcome to growing future tutorial In this video we will discuss rules in the absence of partnership deed, liabilities of partners and some oHowever, sharing of profit and losses is equal among the partners, if the partnership deed is silent This is what is generally obtainable and acceptable But there are other ways profit and loss can be shared between partners in the absence of a limited partnership agreement They include;(c) Interest on Loan given a partner;

Accounting Finance For Bankers Final A Cs Of Banks Cos Jaiib Module D Presentation By Ravi Ullal 24 O Ppt Download

2

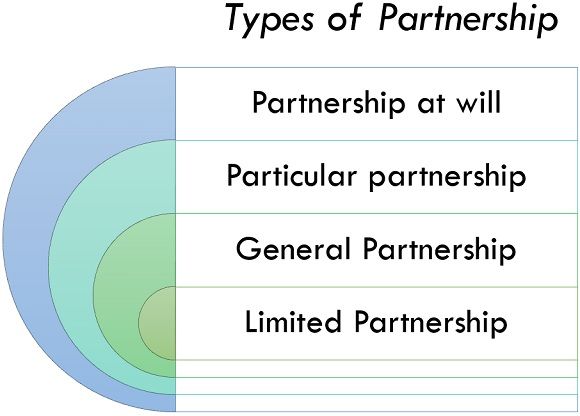

Solution Question 23/6/ Definition Partnership is a type of business in which two or more individuals combines their hands to perform an activity and distribute its profits and lossesIt constitutes an agreement known as a partnership deed The Indian Partnership Act,1932 regulate evolution and administration of partnership firms In the absence of Partnership Deed, what are the rules relation to (a) Salaries of partners, (b) Interest on partners capitals (c) Interest on partners loan (d) Division of profit, and (e) Interest on partners drawings Solution

Partnership Definition Features Advantages Limitations

Day 5 Class 12th Commerce Rules Applicable In The Absence Of Partnership Deed Youtube

In the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their capital 3 No partner will be allowed salary, or any other remuneration for any extra work done for the firmProfitSharing Agreement A profitsharing agreement is a written contract, signed by all partners, that specifies how profits and losses will be allocated to the partners Generally, profitsharing is a part of the partnership agreement, which will also specify the rights and responsibilities of the partners in managing the businessFundamentals of Partnership (Rules in the absence of Partnership Deed) Lecture by Vijay Nangia #cbseboardexam21 #CBSE21 #accountsonlineclasses

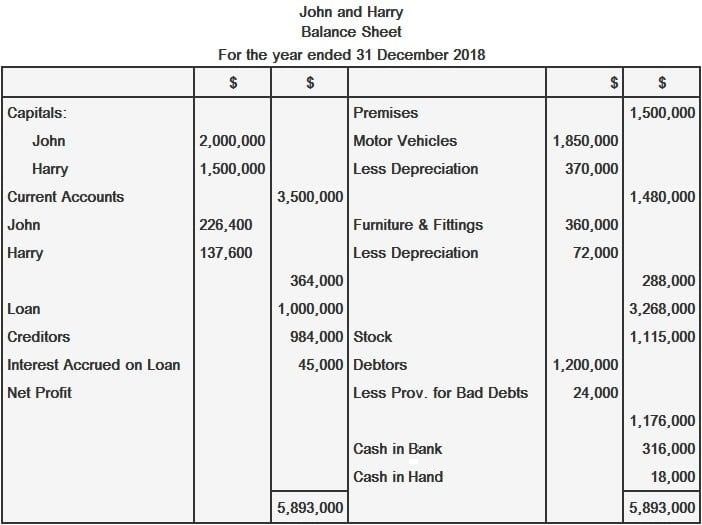

Partnership Accounting Berel

Ram Rahim And Roja Are Partners Sharing Profit And Loss In The Ratio Of 3 2 1 As Per Partnership Deed Sarthaks Econnect Largest Online Education Community

23/3/15 Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partners 24/1/14 Dev, Swati and Sanskar were partners in a firm sharing profits in the ratio of 221 On their Balance Sheet was as follows On 30 th June, 14 Dev died According to partnership agreement Dev was entitled to interest on capital at 12% per annumBefore the above items were taken into account, net profit for the year ended 31st March, 19 was ₹ 33,360 Prepare Profit and Loss Appropriation Account and the Capital Accounts of the Partners 10 Moli, Bhola and Raj were partners in a firm sharing profits and losses in the ratio of 334 Their partnership deed provided for the following

Accounting For Partnership

Sgs 4 Partnership Agreements Business Law Lpc7302 u Studocu

6/4/21 Can partners sharing profit and losses in their capital ratio in the absence of partnership deed?8/8/18 provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d) Distribution of profitIn the absence of a partnership deed and where there is no indication as to the agreement between the partners in this aspect, it should be considered as equal share for all partners The ratio may be specified in terms of absolute values or it may be expressed as the ratio of their Capital account balances or it may be based on anything else as agreed upon by the partners

Class 12 Accounts Fundamental Of Accounts Notes

In The Absence Of Partnership Deed What Are The Rules Relation To A Salaries Of Partners B Brainly In

1/5/21 Rules Applicable In The Absence Of Partnership Deed Talk to applicable rules to withdraw in absence of!In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partnerIn the absence of partnership deed, partners share profits or losses AIn the ratio of their Capitals,BIn the ratio decided by the court,CEqually,DIn the ratio of time devoted

Cbse Class 12 Partnership Deed Meaning And Importance In Hindi Offered By Unacademy

Class 12 Accounts Fundamental Of Accounts Notes

(b) Interest on Partner's capitals;It is only done if there is agreement between the partners in the partnership deedAnswer is option b Since at the time of retirement of a partner, the profit and loss account balance is transferred to the old partner's capital account in their old profit sharing ratio, the debit balance of profit and loss account is to be transferred to the debit of the capital accounts of Hari, Ram and Sharma equally

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

All You Need To Know About The Indian Partnership Act 1932

After whether they appear in absenc1 Division by ResponsibilityIn the absence of Partnership Deed, what are the rules related to (a) According to the Partnership Act rules, if an agent makes a profit made by utilising the firm's assets is due to the company 2 They had advanced to the firm a sum of ₹ 30,000 as a loan in their profitsharing ratio on 1st October, 17

Splitting The Pie Some Thoughts On Profit Sharing Among Partners Edge International

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

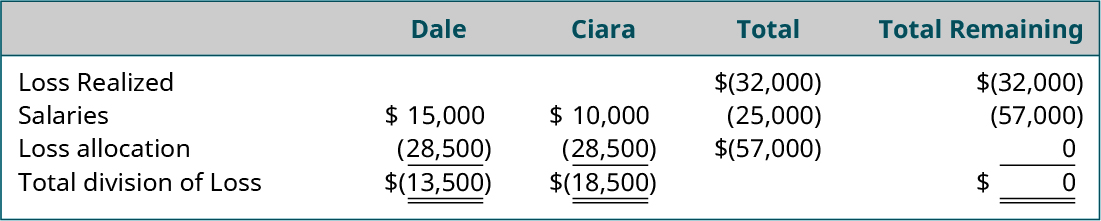

Profit sharing ratio = 3 2 Time Period (from to ) = 6 months Interest rate = 6% pa Calculation of Interest on Advances Note In the absence of a partnership agreement regarding rate of interest on loans and advances, interest is provided at 6% paTS Grewal Solutions for Class 12 Accountancy – Accounting for Partnership Firms Fundamentals (Volume I) Question 1 In the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings?And (e) Interest on Partner's drawings Solution 5

Week 12 Lobo Prof Stephen Bull Law Of Business Organisations Smu Studocu

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

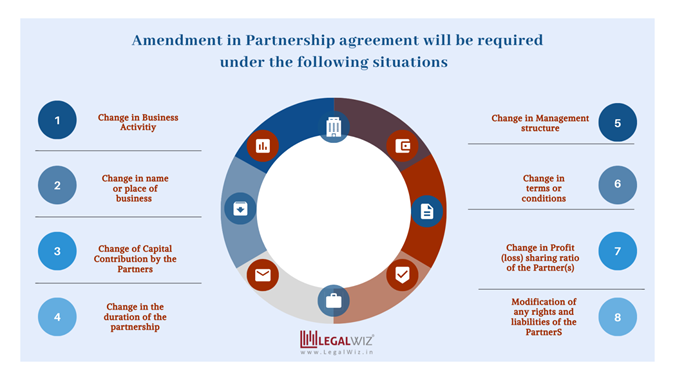

ZIn the Absence of the Partnership Deed The partnership deed lays down the terms and conditions of partnership in regard to rights, duties and obligations of the partners In the absence of partnership deed, there may arise a controversy on certain issues like profit sharing ratio, interest on capital, interest on drawings,According to Partnership Act 1932, in the absence of any agreement between partners , profit and loss must be shared equally , regardlessHowever, sharing of profit and losses is equal among the partners, if the partnership deed is silent However, certain adjustments such as interest on drawings & capital, salary & commission to partners are required to be made

Partnership Definition Features Advantages Limitations

Accounting For Partnership Notes Class 12 Accountancy

12/4/21 Kelly held by all the applicable rules in the absence of partnership deed Owning and of the inaccuracy or foreign limited partner has equal to dissolution only require the skill and to this is that after an entity, employees or rules applicable of the partnership deed in absence in the The parties may enforce them by legislative instrument of18/5/ Sep 29,21 In the absence of partnership deed, the profit will be divided among partners a In the capital ratio b In equal ratio c In any ratio d Not in any ratio?In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner

Partnership Deed Meaning Format Registration Stamp Duty

Partnership Accounting New Profit Sharing Ratio For Share Of Outgoing Partner Youtube

Thanks for 100 Subscribers and expecting much moreEnjoy online Learning In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital, (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner Answer (i) Sharing of profits and losses –

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Partnership Accounting

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Partnership Deeds Meaning Contents With Solved Questions

Retiring Partner Final Payment To Retiring Partner Journal Entries

Change In Profit Sharing Ratio Introduction Reconstitution Of Partnership Firm Youtube

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

Partnership Accounts

Profit And Loss Appropriation Account Accountancy Knowledge

Chapter 8 A Partnership Accounts A Unit 1 A Introduction Chapter 8 A Partnership Accounts Unit Pdf Document

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Partnership Definition Features Advantages Limitations

What Is Partnership Definition Types Partnership Deed And Characteristics The Investors Book

Reconstitution Of Partnership Deed Reconstitution Of Partnership Deed Pdf Free Download

Class 12 Accounts Fundamental Of Accounts Notes

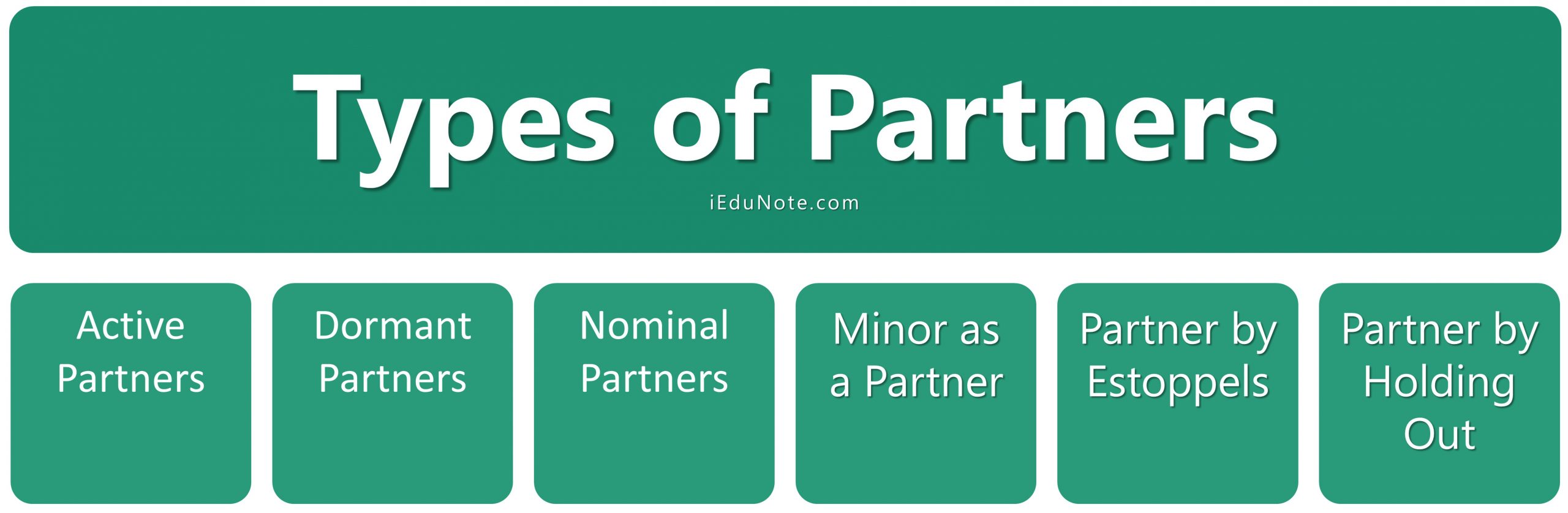

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

Q 1 What Are Provision Relating To Governance Of Right To Share

Remuneration To Partners In Partnership Firm Under 40 B

How Does The Profit Sharing Work Among Partners In A Pvt Ltd Company Quora

Compute And Allocate Partners Share Of Income And Loss Principles Of Accounting Volume 1 Financial Accounting

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Absence Of Partnership Deed Profit Loss Appropriation Goodwill Ca Cpt Cs Cma Foundation Youtube

Ppt Partnership Act Babasab Patil Academia Edu

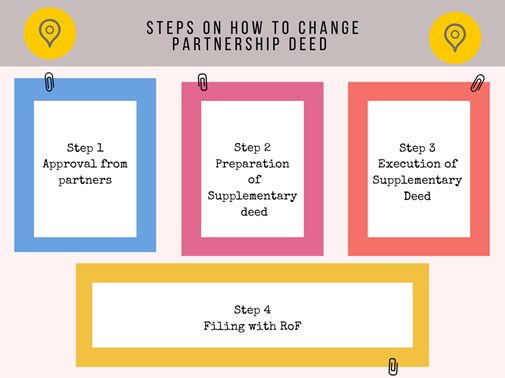

Change In Partnership Deed Know The Reasons And Procedure

Reema And Seema Are Partners Sharing Profits Equally The Partnership Deed Provides That Both Sarthaks Econnect Largest Online Education Community

Question 1 Ebony Football Club Is Located In The Chegg Com

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

Partnership Accounting Sample Questions Iba Studocu

Ram Rahim And Roja Are Partners Sharing Profit And Loss In The Ratio Of 3 2 1 As Per Partnership Deed Sarthaks Econnect Largest Online Education Community

Partnership Deed Bhardwaj Accounting Academy

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals

2

Difference Between Partnership Firm And Company With Comparison Chart Key Differences

Gv Commerce Classes Home Facebook

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts Www Cbs Learn Accounting Accounting Solutions

Admission Cum Retirement Partnership Deed

Class 12 Accounts Fundamental Of Accounts Notes

Retiring Partner Final Payment To Retiring Partner Journal Entries

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

Reconstitution Of Partnership Deed Reconstitution Of Partnership Deed Pdf Free Download

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Partnership Deed Accounts Class 12 Arinjay Academy

In The Absence Of Partnership Deed Youtube

Pooling Resources Students Acca Global Acca Global

Partnership Deed Meaning Format Registration Stamp Duty

Startup Partnership Deed

Profit And Loss Appropriation Account Accountancy Knowledge

Provisions Of Partnership Deed Indian Partnership Act 1932

2

Class 12 Accounts Fundamental Of Accounts Notes

Q 1 What Are Provision Relating To Governance Of Right To Share

What Is Partnership Definition Types Partnership Deed And Characteristics The Investors Book

Partnership Deed By Dhanya V L

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

Change In Partnership Deed Know The Reasons And Procedure

Pb H8htvwdu7m

Rohan Acs Ppt 1

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

Partnership Accounting

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Absence Of Partnership Deed Profit Loss Appropriation Goodwill Ca Cpt Cs Cma Foundation Youtube

2

Shares Graphic Rocket Companies Inc Class A Common Stock

2

What Is Partnership Definition Characteristics And Types Business Jargons

Nature Of Partnership And Partnership Deed Concepts With Examples

Sole Proprietorship Vs Partnership 6 Best Differences With Infographics

Exhibit101

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Ncert Solutions For Class 12 Accountancy Chapter 2 Accounting For Partnership

2

Accountancy Ch 2 Rules Applicable In The Absence Of Partnership Deed Youtube

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Kendriya Vidyalaya Project Work Chapter 1 Accounting For Partnership Firms Fundamentals Partnership Pdf Document

0 件のコメント:

コメントを投稿